EVALUATING & BUYING NBA TOP SHOT MOMENTS USING THE “STAC” METHOD

I want to share my approach to evaluating and buying NBA Top Shot Moments to instill some discipline in sports NFT investing. Success in any form of investing requires discipline, which is a result of solid processes and action. There are plenty of similarities with investing in Top Shot and investing in the stock market, real estate, startups - as a Finance professional I have experience in these are areas and want to apply learnings to Top Shot. All of this requires a foundational framework to help guide you through the decision-making process when considering buying a moment, which I detail below.

My approach is called the “STAC” method which stands for S - Strategy, T - Tools, A - Analysis, and C - Conclusion or Course of Action. Each of these represent the four steps I go through for each of my buy transactions on Top Shot. Time spent may vary depending on whether the moment is $9.00 or $900, but the important thing to remember is that this framework provides discipline and helps to remove some (not all) of the emotional and reactive nature that can distort investment decisions. Let’s break down each further.

Strategy

When I dive into the Marketplace (MP) with the intent to buy, I usually have a theme, idea or an investment hypothesis that I believe can generate a good return. For example, this could be looking for value with potential Hall of Famer’s moments, scooping up MVP/MIP/ROTY moments as the regular season wraps-up, or buying moments on recent news like Lamarcus Aldrige’s retirement announcement.

It is important to make the best use of your two most valuable resources: time and money. With a theme in mind, you force yourself to be focused on what can bring you a ROI and prevent aimlessly browsing the MP that does nothing for your portfolio. You also have limited funds and you need to be selecting strategies and moments that will make your dollars work harder for you, and you can do this with a little homework and discipline. There is no shortage of themes or investing strategies, finding one you believe in a big part of the fun with the Top Shot Platform. If you need a few ideas, take a look at our Investment Ideas section.

In a nutshell, if you’re just browsing for fun...do you! But if you are looking to transact on the MP, do so with intention and a goal in mind.

Tools

Success in most anything not only requires discipline, but also the right set of tools and understanding of how to employ those tools. I will share a few of my go-to’s, but there are plenty out there that you can check out at our NBA Top Shot Resource Guide. Below are four resources I use for each transaction and the purpose of each:

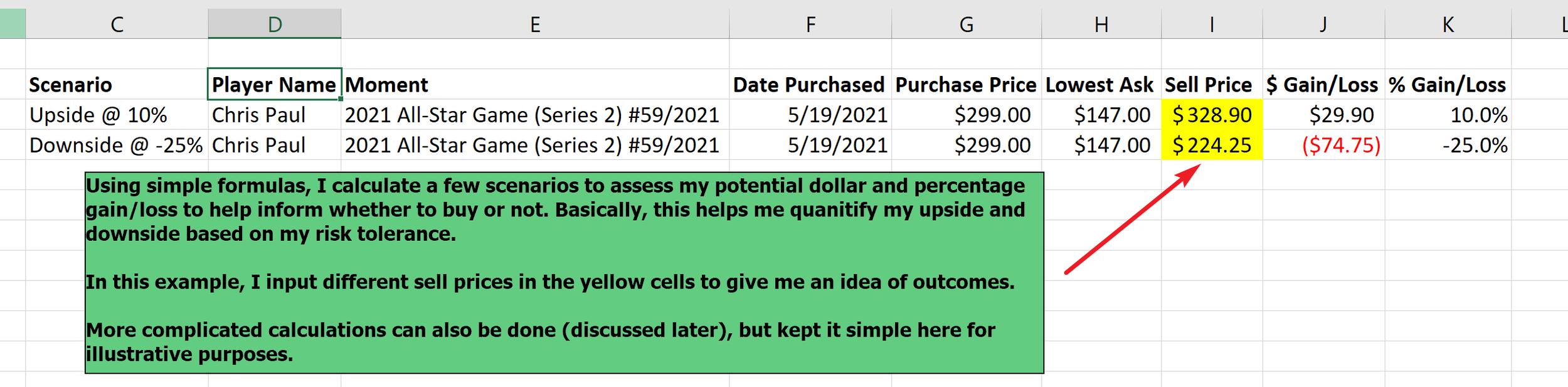

1. Excel spreadsheet or Google sheets: used for importing data from Add More Funds and performing calculations to determine whether a listing price is a deal or not. There are very simple calculations/formulas you should learn for spreadsheets, not only to help with Top Shot but life in general. These include, but not limited to functions such as sum, average, sorting/filtering, quarterlies, minimum/maximum, etc.

2. Add More Funds: I have a subscription with Add More Funds but there is a free-trial you can try which absolutely sold me on the subscription. Namely, the ability to import data into a spreadsheet that otherwise you only have visual access to on other Top Shot websites like evaluate.market. With even basic knowledge of a spreadsheet program, you are able to analyze at a more robust data at a higher level of precision. Information and data are key in investing and Add More Funds provides exactly that in an accessible format.

3. Momentranks: I use the MarketplaceHQ tool to apply smart filters to find value in the area I’m looking for value - Hall of Famers, MVP/MIP/ROTY candidates, as it’s much easier to navigate than the official MP. Additionally, Momentranks Serial Estimator is a unique tool that provides an additional data point - note: it’s not perfect and Momentranks even goes at length to explain this. However, it serves as an important independent resource that may provide more justification to your decision, and more data typically can lead to more favorable outcomes.

4. NBanana Google Chrome Extension: this tool helps fill the gaps where the above two are limited, specifically because it provides a snapshot of the available sale prices of moments currently listed. Additionally, it provides an analysis of the Best Serials available...more information and more data, seeing a theme?

To use these tools effectively you need to know how to apply them, which brings me to the Analysis part of the STAC method.

Analysis

Once I’ve got my tools ready to go, I dive into the analysis of the moments which revolve around certain key metrics that aid in making a more informed buying decision. The intent is to take as much subjectivity and emotion out of the buying process; when emotional or reactive, it can oftentime lead to haphazard decision-making which can be a quick way to losing investments. The key metrics I look at are: pricing history, price to serial ratio, similarly priced serials, and Momentranks value. My process for analyzing is broken down into 5 steps:

Step 1: search for Moments based on my strategy or theme on Momentranks; the reason I use Momentranks instead of the Top Shot platform itself is that the interface and filtering is much more conducive to analyzing the key metrics.

Step 2: select a Moment to analyze, find it on Add More Funds and export the Moment’s transaction data from Add More Funds. Technically, you can see this information in Momentranks interface but its not as easy to manipulate (more on that in the next step) nor does it go back very far, only the last 25 transactions. We want more data to help build context which Add More Funds easily provides.

Step 3: export data from Add More Funds into a spreadsheet, either Microsoft Excel or Google Sheets, and apply filtering and calculations. Adding a filter allows you to quickly sort the information and add the price to serial calculation. Here’s where you will spend your time understanding the key metrics. Here are some questions I consider upon gathering the data:

Pricing History:

Has the Moment’s floor / lowest ask changed recently?

Are the Moment’s transactions occurring every few minutes or only a few per day?

Price to Serial:

I add a column on my speadsheet to calculate the price to serial ratio, which is the price of a given serial number divided by the serial number itself. For example, if a moment is $100 and it is number 25, the price to serial would be $100 / 25 or 4. I then compare this ratio to other similar serials. You want as low of a ratio as possible as compared to similar serials so as to prevent overpaying. A lower price to serial helps identify if a serial is a better “bang for your buck.”

This is not a perfect metric because the lower a price to serial does not necessarily indicate that is truly is a better deal. Because of the serial numbering system, as you have descend into lower serials, there is a price premium. For example, #18 is only ten numbers away from say #8, but #8 should command a much higher premium than #18 given it’s in the top 10. MomentRanks’ Serial Estimator tries to account for this price premium, however, it is my belief that there simply hasn’t been enough time or data for us to get a sense of what these premiums should be. We really only have a relative idea that #1 - 10 may exponentially be worth more than #11-20 and that #11-20 should be exponentially be worth more than anything beyond #50. This is what makes investing in Top Shot early on so intriguing is determining where you believe there is value.

Similar Serials’ Selling Price:

What are similar serials selling for, a few dollars or a few hundred dollars?

Is there a serial that sticks out to you because it’s significantly less than the others around it? Could it be either 1) undercutting is occurring whereby a seller wants to just offload their Moment and will undercut the price point so as to entice a quicker sell, or 2) seller may not have an idea of the fair market value of the Moment and listed a price that doesn’t fit the context of the rest of the prices. Both are wins for you as a buyer.

Momentranks Rank

This data point, while not perfect, gives you a good idea of what the serial is worth. What you are looking for are wide deviations from the moment’s asking price and the MomentRanks serial estimator price which could be an indication that the Moment may be under or overpriced.

Step 4: go back to Momentranks and confirm estimated serial number value - this can serve as a data point if you are potentially getting a good deal.

Step 5: go to Top Shot and check out the Nbanana chrome extension best price analysis and see if your Moment cracks the Top 10 best prices, thus, helping to provide validation for the Moment’s value and serial. This may not always be the case of a serial showing up in the Top 10, that doesn’t mean the serial you are considering is a bad deal. Nbanana has developed it’s own algorithm to determine the best prices, but I always like to have independent sources to help validate a decision.

One Caution: Try to not overanalyze everything. Yes, more information is generally better, but too much information or analyzing every facet of every metric can lead to analysis paralysis. You can spend so much time in the analysis that you don’t ever end up taking any sort of action maybe because the amount of information is overwhelming or the information may not provide a clear *BUY THIS NOW* indication - this is where your own judgement comes into play. Time you spend analyzing is always important, but especially if the MP activity is higher or the Moment activity is high, you may end up losing the opportunity by spending too much time analyzing. Or you may spend so much time analyzing that you don’t actually take meaningful action.

Conclusion / Course of Action:

Once I’ve completed my analysis, I decide on my next step: 1) buy, 2) don’t buy, be grateful for the knowledge obtained and move on, or 3) don’t buy but set a price alert on preferred platform for a potential future buy when circumstances are more favorable. In all of this, don’t lose sight of what’s happening in the macro environment. Is the Top Shot market in a downturn or upswing? You may be getting a deal within the current market but if the overall market is higher, everything may be priced at too high of a premium and it may be better to wait until market conditions change. Context is always important and you need to be aware of that anytime you make a buy decision.

The STAC method does not guarantee you will make a profit, but what it does do is put you in a position to make an informed decision that is fact-based and done so with discipline. And no matter what type of investment, Top Shot Moments, the stock market or real estate, this is what enables the best investors to produce consistently positive returns. Top Shot and sports NFTs may be new, but there is plenty to learn from other areas of investing that can help keep you in the black and maximize your sports NFT collection! Happy investing, happy collecting!